Closings on existing homes picked up last month, while recent commentary shows that Fed members remain cautious about cutting rates too soon. Read on for these stories and more:

-Existing Home Sales Rebound in January

-Fed in No Hurry to Cut Rates

-Tame Initial Jobless Claims During Key Data Week

-Recession Forecast Softened

Existing Home Sales Rebound in January

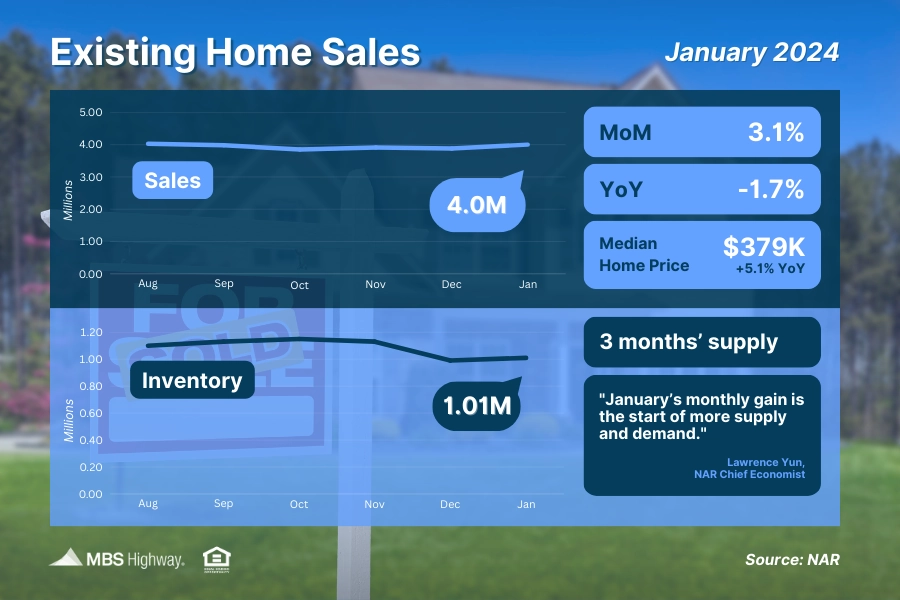

Existing Home Sales rose 3.1% from December to January to a 4-million-unit annualized pace, with December’s sales also revised higher per the National Association of REALTORS (NAR). When compared to January 2023, sales were down 1.7%.

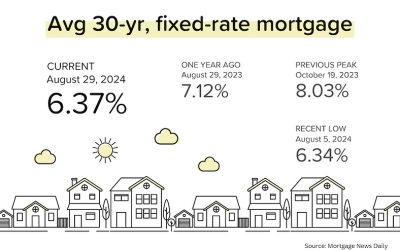

What’s the bottom line? This report measures closings on existing homes in January and likely reflects people shopping for homes in November and December, when rates backed off from their peak. NAR’s Chief Economist, Lawrence Yun, added that “listings were modestly higher, and home buyers are taking advantage of lower mortgage rates compared to late last year.”

Any increase in listings is a positive sign for much needed supply. There were just 1.01 million homes available for sale at the end of January, which is below healthy levels at just a 3 months’ supply of homes at the current sales pace. Meanwhile, demand for homes remains strong, with Yun adding that “multiple offers are common on mid-priced homes, and many homes were still sold within a month.”

This ongoing dynamic of tight supply and strong demand is a key reason why home values continue to rise and why now provides great opportunities to take advantage of appreciation gains.

Fed in No Hurry to Cut Rates

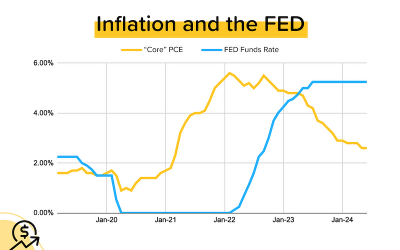

The minutes from the Fed’s January meeting showed that members were generally optimistic that their policy moves had succeeded in lowering inflation. Members also felt they had reached their peak Fed Funds Rate for this cycle.

The Fed Funds Rate is the interest rate for overnight borrowing for banks and it is not the same as mortgage rates. The Fed’s eleven hikes between March 2022 and July 2023 were made to slow the economy and curb the runaway inflation seen over the last few years.

What’s the bottom line? Fed members want to see more data before they ease monetary policy, and they don’t expect to begin cutting rates until they have “gained greater confidence that inflation is moving sustainably toward 2 percent.” This cautious approach from January’s meeting has been echoed more recently by several Fed members, including Philadelphia Fed President Patrick Harker and Fed Governor Christopher Waller.

Note that the Fed’s favored inflation measure, Core Personal Consumption Expenditures (PCE), declined to 2.9% annually as of the latest report for December. January’s PCE report will be released this Thursday, and it will be especially important to monitor the latest numbers after both the Consumer and Producer Price Indexes reported hotter than expected inflation for last month.

Tame Initial Jobless Claims During Key Data Week

Initial Jobless Claims, which measures the number of people filing new unemployment claims, declined by 12,000 to 201,000 in the latest week. Continuing Claims also fell by 27,000, with 1.862 million people still receiving benefits after filing their initial claim.

What’s the bottom line? Initial Jobless Claims are still relatively low, while Continuing Claims have been trending higher since reaching a low of 1.658 million in September. The dynamic we’ve been seeing in the labor sector continues, where employers are trying to hold on to workers, but once people are let go it’s more challenging for them to find new employment.

Note that this was an important real-time report because it includes the sample week that the Bureau of Labor Statistics will use in the modeling for their job growth estimates for February’s Jobs Report. Could the low number of initial unemployment claims skew the headline job growth number in a higher direction?

The Fed is also closely watching employment data as they continue to weigh monetary policy. Members will be carefully analyzing the headline job growth figure when February’s Jobs Report is released on March 8.

Recession Forecast Softened

The Conference Board released their latest Leading Economic Index (LEI), which is a forward-looking index that takes a broad look at the economy and tracks where it’s heading in the near term. January brought a 0.4% drop, marking the 22nd consecutive month of declines. The last time the index fell 22 straight months was in 2007 to 2009, during the global financial crisis.

What’s the bottom line? Despite January’s decline, the Conference Board softened their tone on recession expectations. Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, explained, “While the declining LEI continues to signal headwinds to economic activity, for the first time in the past two years, six out of its ten components were positive contributors over the past six-month period (ending in January 2024). As a result, the leading index currently does not signal recession ahead.”

Family Hack of the Week

Chocolate and peanut butter make for a perfect pair, and these Chocolate Peanut Butter Balls from the Food Network are the perfect way to mark National Peanut Butter Lovers Day on March 1. Yields 24.

In a large bowl, beat 1 cup confectioners’ sugar, 1/2 cup creamy peanut butter, 2 tablespoons unsalted butter (room temperature), 1 teaspoon vanilla extract and 1/4 teaspoon kosher salt with an electric mixer until combined and smooth. Roll the mixture into 24-equal sized balls (about 1 teaspoon each) and place them on a small baking sheet. Chill in the freezer until firm, about 15 minutes.

Heat 6 ounces of roughly chopped bittersweet chocolate and 2 tablespoons unsalted butter in a microwave safe bowl in 20 second intervals, stirring between each with a rubber spatula until melted and smooth.

Using two forks, dip each peanut butter ball into the melted chocolate. Coat evenly and tap off any excess chocolate. Place balls back onto the baking sheet and chill in the refrigerator until chocolate is firm and set, about 1 hour. Serve chilled and refrigerate any extras in an airtight container.

What to Look for This Week

The latest New and Pending Home Sales reports will give us an update on signed contracts for January when they’re released on Monday and Thursday, respectively. We’ll also get appreciation data for December from Case-Shiller and the Federal Housing Finance Agency on Tuesday.

Look for the second reading for fourth quarter 2023 GDP on Wednesday, while Thursday brings the latest Jobless Claims and likely the biggest news of the week via the Fed’s favored inflation measure, Personal Consumption Expenditures.

Technical Picture

Mortgage Bonds were able to break above their 200-day Moving Average on Friday and ended last week testing the next ceiling at the 100.427 Fibonacci level. The 10-year was rejected lower from its 100-day Moving Average and ended Friday testing the next floor at 4.246%.