Week of May 20, 2024 in Review

The pace of home sales declined in April, though the speed at which existing homes sold accelerated. Plus, a parade of Fed speakers and the minutes from their last meeting shed light on their views about inflation, the labor market, rate cuts and more. Here are the headlines:

-Existing Homes Selling Fast

-New Home Sales Slip in April

-Full Week of Fed Chatter-

Initial Jobless Claims Decline During Key Data Week

Existing Homes Selling Fast

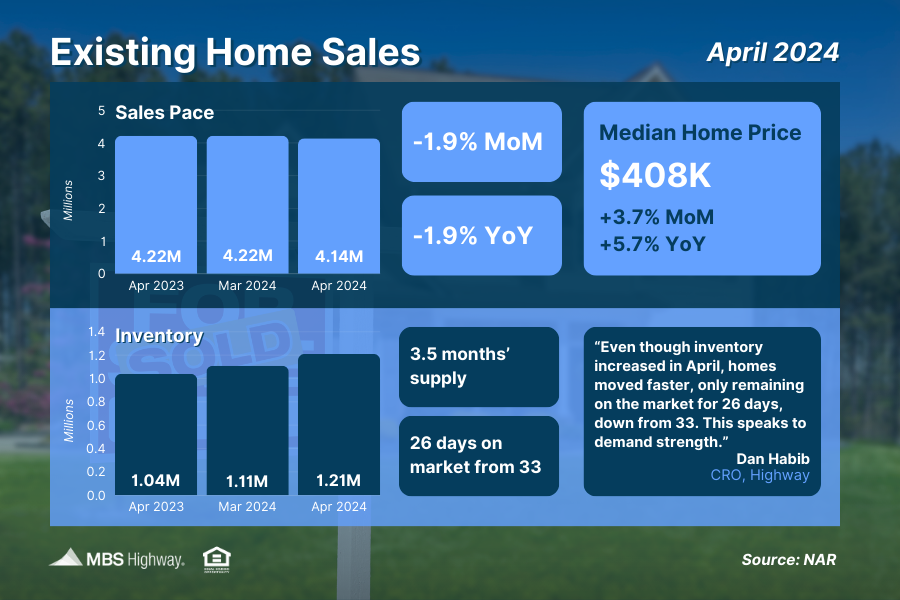

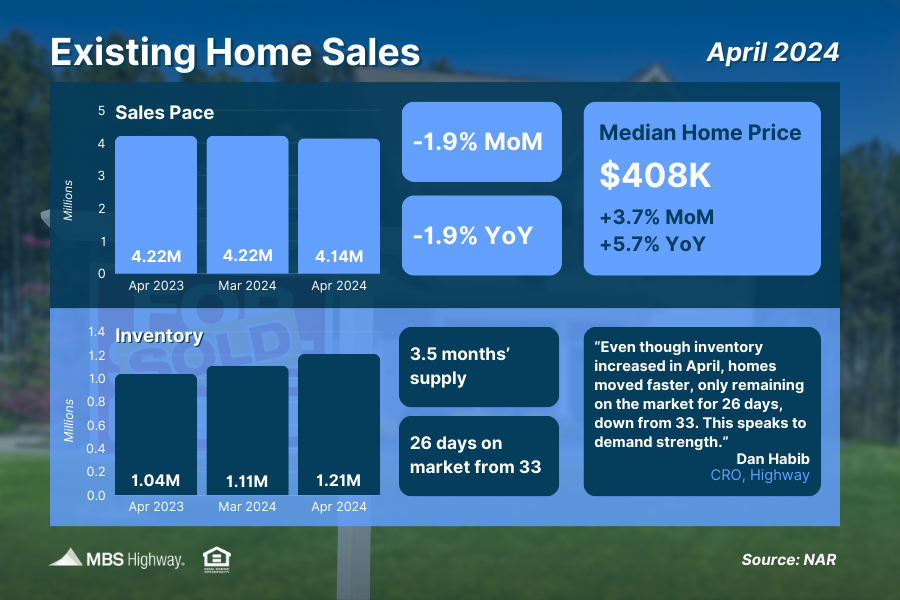

Sales of existing homes fell 1.9% in April to a 4.14-million-unit annualized pace, per the National Association of REALTORS (NAR), though sales in March were revised higher and this offset some of the decline.

This report measures closings on existing homes in April and likely reflects people shopping for homes in February and March.

What’s the bottom line? While the pace of sales declined in April, the speed at which homes sold accelerated. Homes remained on the market for a shorter period in April, with the 26-day average down from 33 days in March. Plus, 27% of homes sold above list price. These factors both signal that demand and competition remain during this spring buying season, even in the face of elevated rates.

Inventory also saw a boost, as the 1.21 million homes available for sale at the end of April were up 9% from March and 16.3% from a year earlier. While this remains below healthy levels at just a 3.5 months’ supply at the current sales pace, rising inventory is certainly a step in the right direction to help improve ongoing tight supply.

New Home Sales Slip in April

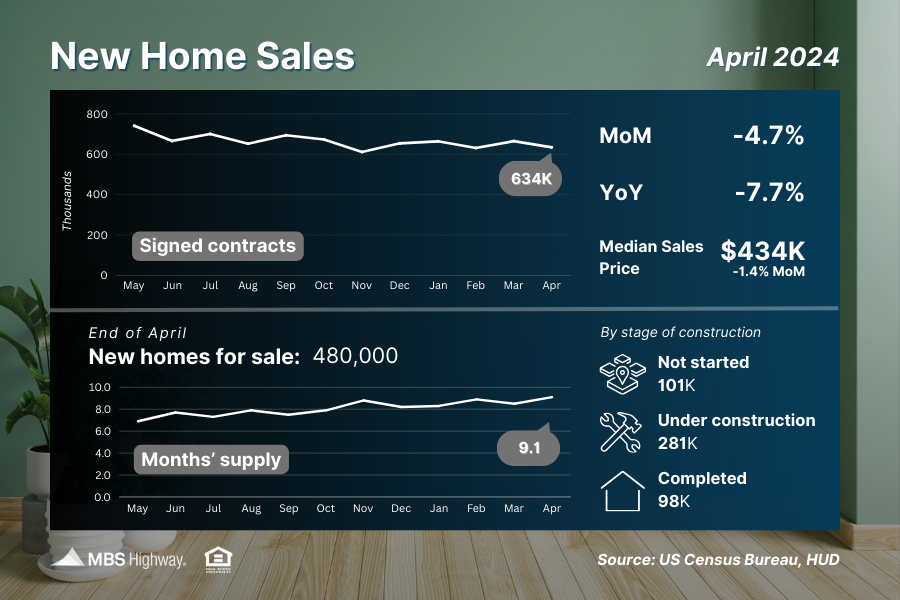

New Home Sales, which measure signed contracts on new homes, fell 4.7% from March to April, missing forecasts that were expecting them to rise. Signed contracts were also 7.7% lower than they were in April of last year.

What’s the bottom line? This report measures buyers who were shopping for homes last month when rates peaked, so the pullback is understandable as some buyers chose to delay their home search.

However, demand for new construction remains strong due to the persistent shortage of existing homes for sale. On that note, more “available” supply is needed to meet buyer demand. While there were 480,000 new homes available for sale at the end of April, slightly higher than the 470,000 seen in the previous report, only 98,000 were completed, with the rest either under construction or not even started yet.

Also, the median home price fell 1.4% from March but this was not due to falling home prices, which continue to rise nationwide per Case-Shiller and other appreciation indexes. The median home price represents the mid-price of sales, meaning it’s influenced by the mix of sales in any given month. Builders are constructing smaller, more affordable homes to meet buyer demand, and that pushed the median home price lower comparatively.

Full Week of Fed Chatter

The minutes from the Fed’s April 30-May 1 meeting were released last week, which showed that members had growing concerns about inflation. This wasn’t a surprise, given that the meeting followed a string of reports showing inflation was more persistent than expected in the first quarter of this year. Since the Fed met, reports have shown cooler inflation as well as slower job growth, a rising unemployment rate and flat retail sales.

Last week also brought a parade of Fed speakers that included notable comments from Fed Governor Christopher Waller, who echoed several of his colleagues when he said, “In the absence of a significant weakening in the labor market, I need to see several more months of good inflation data before I would be comfortable supporting an easing in the stance of monetary policy.”

An easing of monetary policy would bring cuts to the Fed’s benchmark Fed Funds Rate, which is the overnight borrowing rate for banks.

What’s the bottom line? Remember the Fed has been working hard to tame inflation, hiking the Fed Funds Rate eleven times between March 2022 and July 2023. These hikes were designed to slow the economy by making borrowing more expensive, so the demand for goods would be lowered, thereby reducing pricing pressure and inflation.

While inflation was making good progress lower late last year, readings throughout the first quarter of this year were unexpectedly high, causing the Fed to hold the Fed Funds Rate steady as they take a more patient approach to rate cuts than initially thought.

However, as Waller’s comments suggest, a sharp rise in the unemployment rate (which has been in a narrow range between 3.7% and 3.9% since August) could also impact the timing for rate cuts, given the Fed’s dual mandate of price stability and maximum employment.

Initial Jobless Claims Decline During Key Data Week

The number of people filing new unemployment claims declined by 8,000, with 215,000 Initial Jobless Claims reported in the latest week. This followed a decline of 9,000 in the previous week, marking the biggest back-to-back drop since September. Continuing Claims rose by 8,000, with 1.794 million people still receiving benefits after filing their initial claim.

What’s the bottom line? Initial Jobless Claims came in below estimates, while Continuing Claims are also still trending near some of the hottest levels we’ve seen in recent years. The dynamic we’ve been seeing in the labor sector continues, where employers are trying to hold on to workers, but once people are let go it’s more challenging for them to find new employment.

Note that this was an important real-time report because it includes the sample week that the Bureau of Labor Statistics will use in the modeling for their job growth estimates for May’s Jobs Report. While this is just one component, the low reading of 215,000 initial unemployment claims could point to strong job growth when May’s report is released June 7.

The Fed will be closely analyzing this report for signs of labor sector softening as it weighs the timing for rate cuts this year.

Family Hack of the Week

Celebrate National Scone Day on May 30 with these delicious Currant Scones from Martha Stewart. Yields 12 scones.

Preheat oven to 425 degrees Fahrenheit. Line a baking sheet with parchment paper.

In a large bowl, stir together 2 cups all-purpose flour, 2 teaspoons baking powder, 1/4 teaspoon baking soda, 1/2 teaspoon salt and 2 tablespoons granulated sugar. Use a pastry blender to cut in 1/2 cup (1 stick) cold unsalted butter until mixture resembles coarse crumb. Stir in 3/4 cup dried currants. Make a well in the center and add 1/2 cup low-fat buttermilk and 1 large egg (lightly beaten). Stir until just combined; do not overmix.

Transfer dough to a lightly floured work surface and knead 5 or 6 times. Pat into an 8-inch disk. Use a floured 2 1/4-inch biscuit cutter to cut dough into rounds. Reroll scraps and cut additional scones.

Place scones on prepared baking sheet, about 1 1/2 inches apart. Brush with 1 tablespoon milk and sprinkle with 1 tablespoon sugar. Bake until scones are golden brown, around 12 to 15 minutes. Cool on a wire rack. Serve warm or at room temperature with your favorite jam.

What to Look for This Week

More housing reports are ahead, starting Tuesday with appreciation data for March from Case-Shiller and the Federal Housing Finance Agency. April’s Pending Home Sales follow on Thursday.

Also on Thursday, look for the second reading on first quarter GDP and the latest Jobless Claims. Friday brings the most crucial report of the week via the Fed’s favored inflation measure, Personal Consumption Expenditures.

Technical Picture

Mortgage Bonds were able to break above overhead resistance at their 50-day Moving Average, and have a lot of room to the upside before reaching the next ceiling at the 100.427 Fibonacci level. The 10-year ended last week trading in the lower part of a range between support at the 50-day Moving Average and overhead resistance at the 25-day Moving Average.

(Source: MBSHighway.com)