It’s time to start cutting rates, said Fed Chairman Jerome Powell in his speech from Jackson Hole last Friday. Anticipating this policy shift, mortgage rates have already moved more than 1% lower in the last four months, improving mortgage affordability and making millions of loans refinance-able.

“The time has come for policy to adjust.” We thought that Jerome Powell might have something exciting to say from Jackson Hole, and he sure did. Rate cuts will start on September 18. Powell’s speech focused on the employment part of the Fed’s “dual mandate” (low inflation + full employment). The unemployment rate climbed to 4.3% in July, and the Fed wants to avoid “unwelcome further weakening in labor market conditions.” [More on this later.]

New home sales jumped in July. July new home sales were much stronger than expectations, rising 10.6% MoM. June sales were also revised 8% higher.

Case-Shiller: Price growth slows. The seasonally-adjusted Case-Shiller national home price index rose 0.2% month-over-month in June, a slowdown from +0.3% in each of the previous three months and +0.5% in each of Jan and Feb. That said, national prices are already up 2% year-to-date. Four of the big city indexes saw MoM declines in June: Charlotte, Dallas, Phoenix and Portland. [Source: S&P Global]

FHFA: Home prices flat in June. According to the FHFA, national home prices FELL 0.1% MoM on a raw basis in June, but were flat on a seasonally-adjusted basis. The strongest (seasonally-adjusted) price growth was in the East South Central region (+0.7% MoM, AL/KY/MS/TN). The biggest price decline was seen in the Mountain region (-0.7% MoM, ID/MT/CO/WY/UT/AZ/NV).

Reminder: While the approach is similar to Case-Shiller (the very accurate repeat sales method), the FHFA’s dataset only includes homes financed with conforming mortgages. That means that it excludes homes purchased with cash or financed by jumbo/commercial loans. That’s why the home price appreciation numbers can be a bit different.

Q2 GDP revised up. The first (advance) reading was 2.8% annualized GDP growth. The second (preliminary) reading was bumped up to 3.0%, with personal consumption (you and me spending on stuff) the primary driver.

Pending sales disappointed. The NAR’s pending home sales index dropped 5.5% MoM in July (-8.5% YoY) to 70.2. That’s the lowest index level in decades. Why haven’t lower mortgage rates boosted buyer demand? Don’t worry, they will. But it takes time, and mortgage rates had their big move lower only in late July.

What the Fed Said

Before we look at snippets from Powell’s Jackson Hole speech, let’s set the table:

- Inflation (core PCE) has declined from 5.6% YoY in March 2022 to 2.6% in June 2024. The Fed’s target is 2.0%. We’ll get the July PCE number on Friday (today), with consensus expecting another 2.6% figure.

- The minutes from the Fed’s last (July) meeting revealed that “The vast majority [of Fed members] observed that, if the data continued to come in about as expected, it would likely be appropriate to ease policy at the next [Sept 18] meeting.”

- The unemployment rate (“UR”) has risen from 3.4% in April 2023 to 4.3% in July 2024. That’s still a low UR, but the nearly 1% increase since the bottom is a recession red flag.

- The latest QCEW (Quarterly Census of Employment and Wages) report showed that the job gains previously reported by the BLS between March 2023 and March 2024 had been revised lower by 818,000!

In a nutshell, two things have been rising at the Fed: confidence that inflation is under control, and concern that employment might be slowing too quickly. The following are direct quotes from Chairman Powell’s Jackson Hole address, with my clarifying comments in brackets.

Today, the labor market has cooled considerably from its formerly overheated state. The unemployment rate began to rise over a year ago and is now at 4.3 percent — still low by historical standards, but almost a full percentage point above its level in early 2023. Most of that increase has come over the past six months.

All told, labor market conditions are now less tight than just before the pandemic in 2019 — a year when inflation ran below 2 percent. It seems unlikely that the labor market will be a source of elevated inflationary pressures anytime soon. We do not seek or welcome further cooling in labor market conditions.

The time has come for policy to adjust [from tightening to loosening]. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.

We will do everything we can to support a strong labor market as we make further progress toward price stability. With an appropriate dialing back of policy restraint [rate cuts], there is good reason to think that the economy will get back to 2 percent inflation while maintaining a strong labor market. The current level of our policy rate gives us ample room to respond to any risks we may face, including the risk of unwelcome further weakening in labor market conditions.

The Rate Cuts are Coming

Now we know when the rate cuts will start, but how much and how often? It will depend on the data, of course, but there are a few lessons we can learn from the history of past Fed loosening (rate cut) cycles:

- It’s fairly common for the Fed to start with a 50 bps (0.5% or half a percent) cut

- The first rate cut often happens just before, or coincident with, a recession [gray bars in the chart below].

- Rate cut cycles can last up to two years (it depends on the severity of the economic downturn, they move faster in a confirmed recession)

- You usually end up with the Fed reversing about 70–80% of the rate hikes from the previous tightening cycle. The Fed lifted rates by 525 bps (5.25%) between March 2022 and July 2023.

Effective Federal Funds Rate since 1955

On the Case (Shiller)

Home price growth is slowing. Both the Case-Shiller and FHFA price indexes show that. But this is neither a surprise (growth can’t stay high forever), nor a warning sign (prices are still up a respectable 1.5–2.0% year-to-date). When you consider how much home prices have risen in the last 3–4 years, it is completely normal for a few years of below average growth to follow.

Here’s what I took away from a deeper look at the Case-Shiller national and big city indexes:

- The 10-biggest city composite index (+0.52% MoM) continues to massively outgrow the national index (+0.16% MoM). Prices in New York City (part of the 10-city index) have risen an average of 0.93% per month over the last 4 months!

- The strongest growth came from San Diego (+0.7% MoM, up 3.5% year-to-date), New York City (+0.6% MoM, up 4.8% year-to-date), Los Angeles (+0.6% MoM, up 2.8% year-to-date), and Cleveland (+0.3% MoM, up 3.6% year-to-date).

- Four big city indexes declined month-over-month: Phoenix and Portland (both down around 0.2%) and Charlotte and Dallas (both marginally down). Prices in Dallas and Phoenix have now declined MoM for four straight months. In May, only three cities declined MoM.

- 7 big city indexes are still below their mid-2022 peaks. Prices in San Francisco are 6.8% below where they were two years ago. Prices in Phoenix are 4.4% below where they were two years ago.

Mortgage Market

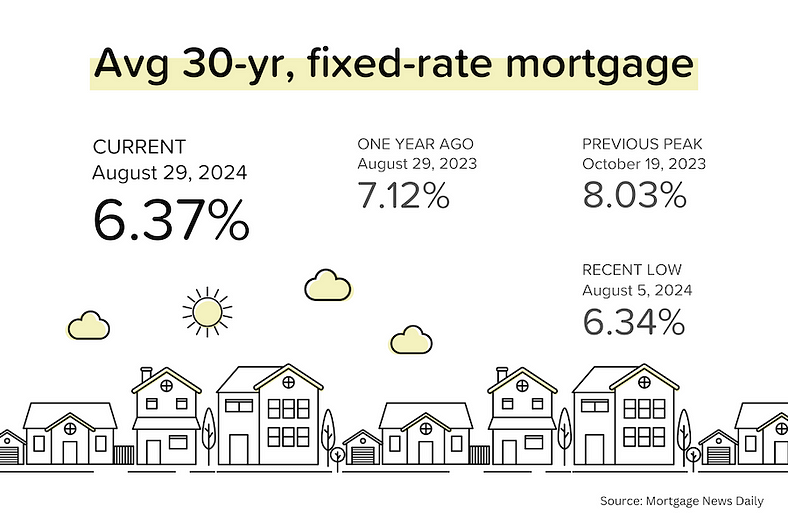

Another good week for potential buyers (or refinancers), with average 30-year mortgage rates dropping below 6.4% as the market reacted to the Jackson Hole speech. Mortgage rates have now dropped more than 1% in the last four months, shaving $200–300 off the typical monthly mortgage bill.

Here are the current odds on Fed rate cuts at upcoming FOMC meetings:

- Sept 18: 100% (same as last week); the probability of a 50 basis points at 34% (up from 25% last week).

- Nov 5: US presidential election

- Nov 7: 100% (same as last week); 44% probability that rates will be 75 basis points lower than current (up from 39% last week)

- Dec 18: 100% (same as last week); 45% probability that rates will be 100 basis points lower than current, about the same as last week.

They Said It

“A sales recovery did not occur in midsummer. The positive impact of job growth and higher inventory could not overcome affordability challenges and some degree of wait-and-see related to the upcoming U.S. presidential election.” — Lawrence Yun, NAR’s Chief Economist.

“Before accounting for inflation, home prices have risen over 1,100 percent since 1974, but have slightly more than doubled (111%) after accounting for inflation.” — Brian D. Luke, Head of S&P DJI Commodities, Real & Digital Assets