Simplify Your Mortgage With Low Fees, and Great Service

Whether you're buying a home or refinancing, we’ll secure a great rate and great terms—fast, simple, and stress-free!

Your Trusted Mortgage Broker in Omaha & Lincoln, NE

Competitive Rates. Personalized Service. Fast Approvals.

At Capital City Mortgage, we’re more than just mortgage brokers — we’re your dedicated home loan strategists. Whether you’re buying your first home, refinancing, or upgrading to your dream home, we combine personalized service with unbeatable local insight to get you the best possible mortgage solution.

Start with Confidence: Get Pre-Approved Today

Don’t wait until you find the perfect home — get pre-approved now and shop with confidence. We’ll walk you through the process and help you understand your true buying power with no pressure and no surprises.

Mortgage Brokers in Omaha & Lincoln

Looking for a mortgage broker in Omaha, NE or Lincoln, NE?

Why settle for a one-size-fits-all loan from a big bank? Our local team in Lincoln and Omaha delivers tailored loan solutions, competitive rates, and faster closings. We know the Nebraska market inside and out, and our clients feel the difference.

Why More Homebuyers Choose Capital City Mortgage

Lower Rates: With great rates and low fees, you keep more funds in your pocket.

Faster Closings: A simple and streamlined process means faster closings — often clearing to close in under 15 days.

Expert Advice: You’ll work with an experienced mortgage broker who answers your questions, not a call center.

Personal Service: We treat you like a neighbor, not a number.

Today's Mortgage Rates in Omaha & Lincoln

Rates change daily, and timing is everything. Let us help you lock in a great rate while it lasts.

Talk to a local expert today and see what’s possible.

Home Loan Products

Simplified Loans, Smarter Homeownership

Conventional

FHA

VA

USDA

Jumbo

Non-QM

Reverse

Conventional Loans

Unlock the benefits of homeownership with a flexible, competitive conventional loan. With down payments as low as 3% and no mortgage insurance at 20% down, you save more over time. Higher loan limits and great rates make it a top choice. Contact Capital City Mortgage today to start your journey with confidence!

FHA Loans

An FHA loan makes homeownership possible with just 3.5% down and flexible credit requirements. Perfect for first-time buyers, it offers low rates and easier qualification. As mortgage brokers in Lincoln and Omaha, we secure some of the best pricing to save you more. Contact us today to explore your FHA loan options!

VA Home Loans

VA loans offer veterans and active-duty military zero down payment, low interest rates, and no PMI—making homeownership more affordable. At Capital City Mortgage, we specialize in securing the best VA loan rates in Lincoln and Omaha. You’ve earned these benefits—let us help you take advantage of them. Contact us today to get started!

USDA Mortgages

USDA home loans offer 100% financing, low rates, and affordable payments for buyers in eligible rural areas. With flexible credit guidelines and no reserve requirements, it’s a great option for low-to-moderate-income borrowers. At Capital City Mortgage, we’ll help you navigate the process and secure the best deal. Contact us today to see if you qualify!

Jumbo Loans

Jumbo loans provide the financing needed for luxury homes and high-value properties, exceeding conventional loan limits. With flexible options for high-income borrowers, they’re ideal for competitive markets. At Capital City Mortgage, we’ll guide you through qualification and secure the best terms. Ready to finance your dream home? Contact us today to explore your jumbo loan options!

Non-QM Mortgages

Non-QM loans offer flexible financing for self-employed borrowers, those with credit events, or non-traditional income. With alternative income verification and diverse loan options, they provide solutions beyond conventional mortgages. Capital City Mortgage specializes in helping you navigate Non-QM loans to fit your needs. Contact us today to explore your options and achieve homeownership on your terms!

Reverse Mortgage Loans

At Capital City Mortgage, we understand that your home is a valuable asset, especially during retirement. Serving the Nebraska community from our Lincoln and Omaha offices, we specialize in reverse mortgages, a financial tool for homeowners 62 and older. A reverse mortgage allows you to access your home equity as tax-free funds without selling your home or making monthly mortgage payments, offering financial flexibility to supplement your income, cover expenses, or simply enjoy life more fully. As a mortgage broker, we are committed to providing transparent, personalized service, guiding you through every step of the process to determine if a reverse mortgage is the right path to secure your financial future and the retirement you deserve. Contact us today for a free consultation and let us help you explore your options.

Purchase Pro

Start here for quick advise about your new home loan and purchase.

Quick Quote

Curious where mortgage rates are? Click here for a quick update.

Refinance Pro

Looking for advise about a mortgage refinance? Click here.

Ask a Professional

Got a mortgage or home loan question?

Click here and ask.

Top Mortgage Questions

How to find a mortgage lender in Omaha?

With so many option available, it can be overwhelming to choose the perfect mortgage lender in Omaha. But don’t worry, we’ve got you covered.

Why you need a mortgage lender in Omaha

A mortgage lender plays a crucial role in the home buying process. They provide the financial assistance you need to purchase your dream home. A good mortgage lender will offer competitive interest rates, a simplified loan process, and proactive communication. With a mortgage lender in Omaha, you will be working with a mortgage professional who understands the local market and can guide you through the complexities of the mortgage process.

How to find a mortgage lender in Omaha

So, how do you find a reliable mortgage lender in Omaha? Here are some tips to get you started:

- Ask for referrals: Ask family, friends, or colleagues who have recently purchased a home in Omaha for recommendations.

- Check Online Reviews: Research mortgage ledners online and read reviews from customers.

- Compare Rates: shop around and compare interest rates, fees, and terms offered by different mortgage lenders.

- Check credentials: ensure that the mortgage lender is licensed and has a good standing with the Nebraska Department of banking and finance.

Get Started Today

Finding a mortgage lender in Omaha doesn’t have to be daunting. By researching, asking the right questions, and comparing options, you can find the perfect mortgage lender to help you achieve your dream of homeownership. Don’t wait any longer – learn the benefits of working with Capital City Mortgage today!

How to find a mortgage lender in Lincoln?

Selecting the perfect Lincoln mortgage lender from the variety of options available can be overwhelming. We can help you with that.

Why You Need a Lincoln Mortgage Lender

A crucial aspect of purchasing a home is having a mortgage lender on your side. They provide the financial guidance and assistance needed to purchase your dream home. Essential qualities of an excellent mortgage lender include competitive interest rates, a straightforward loan application process, and proactive communication.

Partnering with a Lincoln mortgage lender connects you with a mortgage expert well-versed in the local market, guiding you through the complexities of securing a mortgage.

How to Find a Lincoln Mortgage Lender

Here are some tips to help you find a reliable mortgage lender in Lincoln:

- Seek Recommendations: Reach out to family, friends, or colleagues who have recently purchased a home in Lincoln.

- Read Online Reviews: Research and read customer reviews of mortgage lenders online.

- Compare Rates: Do your due diligence and compare terms, fees, and interest rates from different lenders.

- Verify Credentials: Ensure the lender is in good standing with the Nebraska Department of Banking and Finance and holds a valid license.

Kickstart Your Home Buying Journey

Finding a mortgage lender in Lincoln doesn’t have to be daunting. By conducting research, asking the right questions, and weighing your options, you can find the perfect lender to help you achieve your homeownership dreams.

Don’t delay any longer

Take advantage of the benefits offered by Capital City Mortgage today!

Mortgage Updates

First-Time Homebuyer Success

Embarking on the journey of purchasing your first home is a thrilling and sometimes daunting experience. As a first-time homebuyer, you may face challenges ranging from understanding financial jargon to navigating the complexities of the housing market. However, with...

What is the easiest home loan to get approved for?

Buying a home is a significant financial milestone, and choosing the right mortgage can make all the difference. Understanding the different types of home loans and their respective qualification criteria is crucial for prospective homebuyers. In this blog post, we'll...

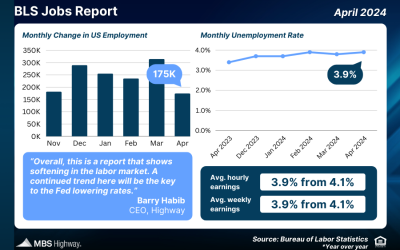

Market Update – 5/6/2024

Week of April 29, 2024 in Review The Fed once again held rates steady, labor sector data showed signs of softening, and there’s more evidence of rising home values across the country. Read on for these stories and more: - Fed Shuts Down Rate Hike Chatter - Jobs...

What is a Mortgage Pre-Approval, and How Does it Work?

If you're in the market to buy a home, you've likely heard the term "mortgage pre-approval" thrown around. But what exactly does it mean, and how does it work? In this comprehensive guide, we'll break down everything you need to know about mortgage pre-approval, from...

Frugal Fun: How to Make it Fun Saving Money

Maintaining a social life while on a budget can be a real struggle. It often feels like we have to choose between having fun and being financially responsible. However, finding frugal ways to have fun is not only possible but also beneficial for our overall...

What’s Happening – April, 2024

Check out some of the fun and unique activities happening around the area or click the links below for a full list. Lincoln Events - Omaha Events - Nebraska Events Following a one-year hiatus, PBR (Professional Bull Riders) will return to Lincoln, Nebraska,...