Buying a home is one of the most significant financial decisions you can make, and it’s natural to want to time your purchase perfectly. Many prospective buyers hold off, hoping for interest rates to dip before they take the plunge. However, this strategy can backfire, leading to missed opportunities and higher cost of waiting. Let’s explore why waiting for rates to come down might not be the best move.

The Only 3 Things Rates Can Do

1) The Rate Stays Where It Is: If rates remain unchanged, historical trends suggest that home prices will continue to rise. This means that waiting might result in higher prices for the same property in the future. The longer you wait, the higher the home prices could climb, making your dream home more expensive.

2) The Rate Can Go Up: If interest rates increase, the cost of borrowing will be higher. A higher rate means larger monthly mortgage payments and potentially higher home prices as well. This double hit can significantly impact your buying power, reducing the size or quality of the home you can afford.

3) The Rate Can Go Down: While a drop in rates might seem like the ideal scenario, the reality is you can still benefit from lower rates through refinancing if you purchase now. Refinancing allows you to take advantage of falling rates without missing out on the current housing market conditions. This way, you get the best of both worlds: owning a home now and paying less in interest later.

Missed Appreciation Benefit

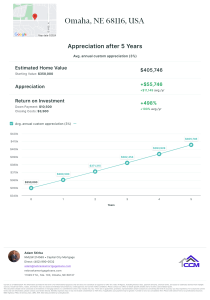

One of the most substantial losses when waiting for rates to drop is missing out on home appreciation. Homeownership has long been a cornerstone of building wealth. According to a 2022 study, homeowners had a median net worth of over $396,000 compared to just $10,400 for renters. This stark contrast underscores the financial benefits of owning a home.

Click to View

Increased Buyer Competition

The economic news during the week of July 29, 2024, indicated a drop in interest rates. This decline, coupled with potential future decreases, might lead to increased buyer competition. More buyers entering the market means higher demand, which often results in rising home prices and more bidding wars. Competing against multiple buyers can drive prices above the asking price, further inflating costs and making it more challenging to secure your desired home.

When there’s more competition and not an abundance of inventory, you could face the stress and frustration of bidding wars, ultimately paying more than the home’s listed price. Waiting for rates to drop could put you in the middle of a highly competitive market, reducing your chances of finding and affording the perfect home.

Limit Your Cost of Waiting

If you’ve been contemplating buying your first home, moving up to a larger property, or downsizing, it’s essential to consider the broader picture. Historical trends suggest that home prices will continue to rise, regardless of interest rates. With rates where they are now, it might be a great time to make a purchase. If rates drop in the future, refinancing can help you take advantage of lower rates while still benefiting from the appreciation of your home.

In the world of real estate, waiting can be costly. Rather than trying to time the market perfectly, focus on the long-term benefits of homeownership. Start building equity and wealth now, and position yourself to refinance if rates decline. The cost of waiting might be higher than you think, so take action today and secure your financial future.

How Mortgage Payments are Calculated

For many people, owning a home is a dream that requires financial planning and careful consideration. One of the most important aspects of homeownership is understanding how mortgage payments are calculated. While the process may seem complex, this blog post will...

When to get a mortgage pre-approval

Buying a home is a significant investment, and before embarking on your search, securing a mortgage pre-approval is crucial. This step provides clarity on your borrowing capacity and potential loan options. This will help streamline your property search. However,...

What is an escrow account in a mortgage?

Purchasing a home is a significant financial decision, and most homeowners rely on a mortgage to fulfill their dream. However, the mortgage process can be complex, filled with unfamiliar terms and concepts. One such term is an escrow account. If you are a first-time...